Trend: The plunge in equity prices last week ended right on expected support. For SPY, that support was the bottom of the range that has persisted for 10 of the past 11 months. Risk/reward was attractive at the low; as price moves higher towards the top of the range, it becomes less so.

Support for NDX at the mid-November low held; price is now back to about 1% from the top of the 5-month range.

DJIA is also about 1% from the recent November high resistance, but there is room in its larger channel to move 3% higher to the top of its 11-month range. Of note is that DJIA will have a golden cross tomorrow, together with SPX (SPY and NDX have already had their golden cross; chart here).

So will US equities continue to run higher? Our best guess is that strength into year-end will be retraced in the new year. In other words, if Santa comes, fade him.

Seasonality: One the factors arguing in favor of a run higher is of course seasonality. The period from mid-December until early January is normally very bullish. Given the steep fall in the past week, that pattern might be especially potent as traders gave up on the year-end rally (today is Day 13; data from Sentimentrader).

Sentiment: Even before the plunge at the end of last week, more than $13b had flowed out of equity funds in the prior 5 days. That was a multi-year high and reflected extreme pessimism among traders.

This week, the Investors Intelligence bull/bear ratio dropped to 1.3x, the lowest since mid-October. The AAII bull-bear spread dropped to minus 15%, the second lowest in nearly 3 years. Evidence points mostly to excessive bearishness at a time of the year when investors are normally bullish.

Moreover, globally, fund managers are sour on US equities: they are now 19% underweight the US, an 8 year low. US equities normally outperform under similar instances (data from BAML; a full post on this here).

Also, fund managers are heavy cash (5.2% of their assets). Again, similar levels are associated with positive equity performance (data from BAML).

Volatility: Last week ended with VIX over 20. On Monday, VIX was 3 standard deviations above the mean: an extreme. Finally, the VIX term structure had inverted at the lows. Normally, volatility would subside after events like these. That should especially be the case as the markets head into the holidays.

Macro: The FOMC elected to initiate a rise in rates this week. This reflects confidence in the economy that is subsequently reflected in positive gains in equities. That linkage is both intuitive as well as empirical (data from Allianz).

Real retail sales this week climbed to a new all-time high. Consumption continues to grow.

Housing starts are up 16% in the past year; the latest figures show starts at the fourth highest level in the past 8 years. Permits are the second highest in 8 years. Strength in housing has a strong follow-on affect into the rest of the economy.

Services are more than 80% of the US economy. The manufacturing part of the economy is mostly doing fine, with the exception of oil/gas refining and mining. When those sectors are included, industrial production looks weak; excluding those segments, industrial production is at an 8 year high. Given the massive oversupply of energy, weakness in that sector is unsurprising. Painting the entire manufacturing sector as weak is misleading.

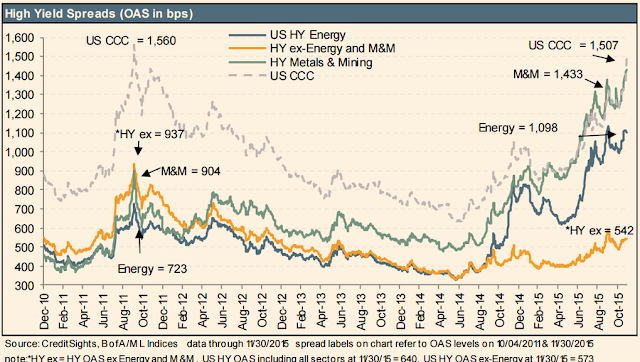

The plunge in oil prices has had its most visible impact on the high-yield market. As Goldman points out, aberrations in high-yield spreads are focused there; the rest of high-yield is not overly stressed. There is no recession signal here.

The difference in spreads between mining (green line), energy (blue) and the rest of high-yield (yellow) are easily apparent (data from BAML).

More generally, the notion that high-yield spreads are a good leading indicator of economic trouble is overstated. Spreads have spiked 5 times in 30 years; 3 occurred with a recession and 2 did not. This is a very small sample and even within it, the data is mixed. There is no reliable signal here (data from BAML and GS).

So seasonality, sentiment, volatility and macro point to further upside. The indices have been moving sideways for a year and but have further room to run to their upper end. Normally, a move higher to the upper end would be expected under these circumstances.

There are two watch outs.

First, equities gained more than 1% on yesterday's FOMC meeting. Strong gains on an FOMC day are normally given back: it could be immediate or it could be over the next month. Here are the recent similar instances with the retrace percentages shown.

Not shown on the chart is March 2015, another instance where SPX gained more than 1% on an FOMC day. A week later, the index was 2% lower.

Of note is December 2013 in the chart above; the index continued higher for more than a month before sliding 4% lower. Positive seasonality could play out in a similar way now.

Looking back further, strength on FOMC days usually fades after 1-2 weeks (red line are gains of 1% or more; data from Stock Almanac).

The second watch out is that, while the initiation of higher rates is positive for equities, there is a tendency for short term weakness within the first two months or so: SPX sold off by at least 5% in the months after the last 4 rate hike cycles began. A full post on this topic is here.

A nice set of charts highlighting this pattern is in this MarketWatch article (here). We've highlighted the weakness after each rate hike below.

The best set-up would be for negative sentiment and positive seasonality to push equities higher (or at least not significantly lower) into year-end. With indices at the high end of their range, we would have a solid set-up for expecting weakness to begin the new year.

This is the final post for the Fat Pitch in 2015. Have a safe and happy holiday and end of to your year.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.